AMD’s CEO Dr. Lisa Su expects AMD to continuing growing its PC business in 2026, despite a crunch of component pricing that the company believes will shrink the PC market overall. In a response on memory pricing in the client segment, Su said, “Our focus areas are enterprise… and just continuing to grow at the premium, you know, higher-end of the market.”

Memory prices (and more recently SSD prices) have presented a significant hurdle for building a new PC, and despite prices starting to level-off, there’s no sign of prices dropping any time soon. Given these pressures, AMD says it expects the PC market to shrink overall in 2026.

AMD Q4 2025 and Full Year Financial Results

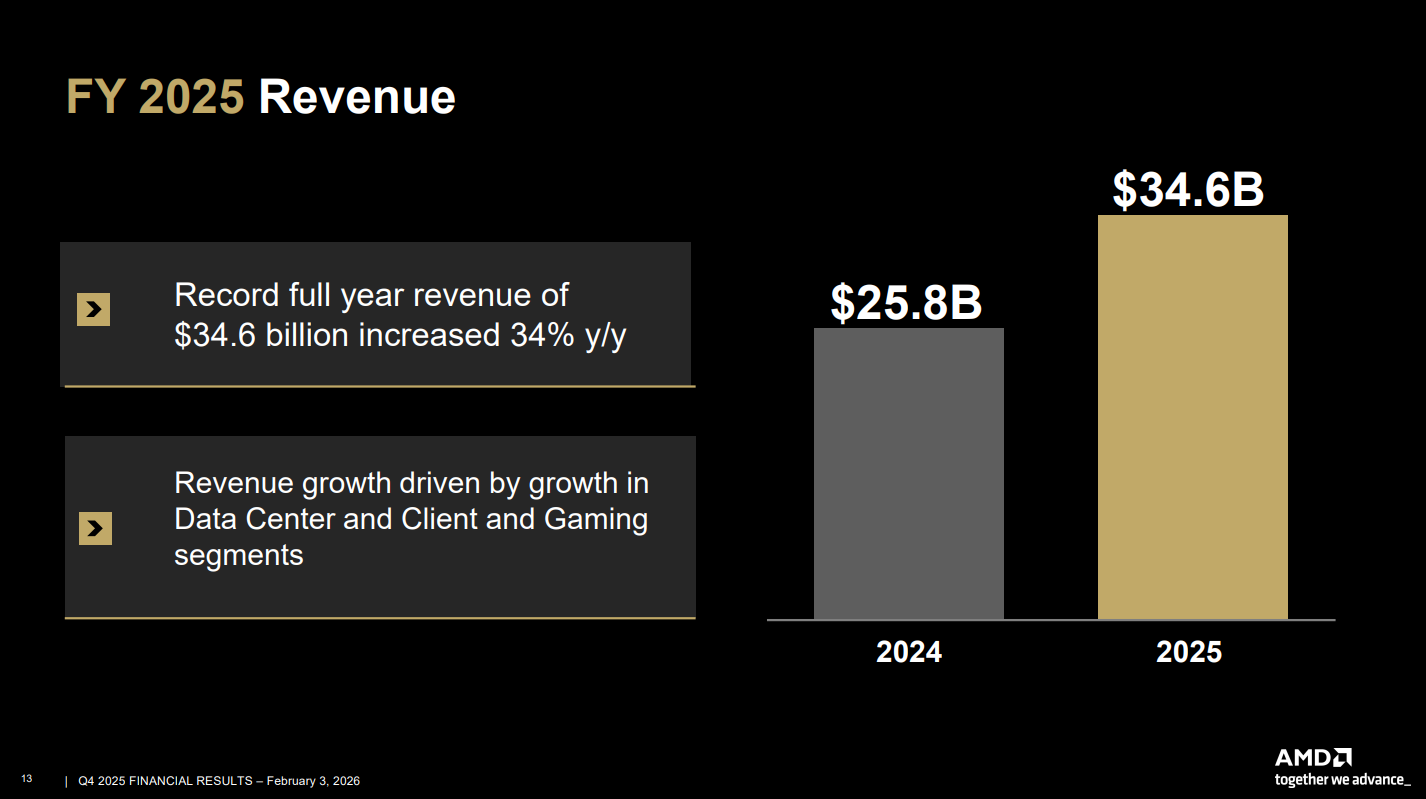

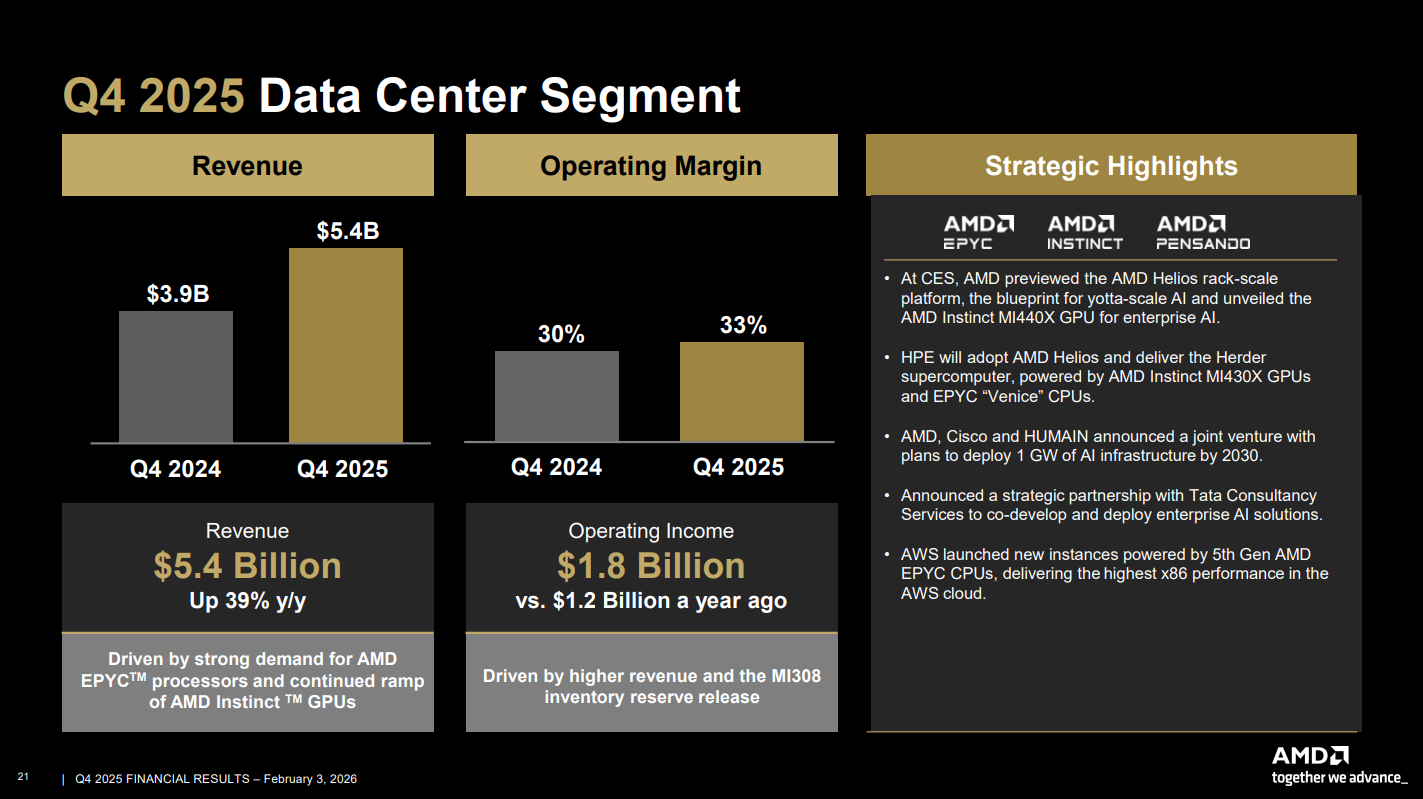

Overall, AMD brought in $10.3 billion in revenue for the quarter, up 34% year-over-year, bringing revenue for the full year up to $34.6 billion. The results include $440 million in inventory of Instinct MI308 accelerators, approximately $360 million worth of which was released from export control. For the fourth quarter, AMD says its total MI308 revenue for sales to China was approximately $390 million.

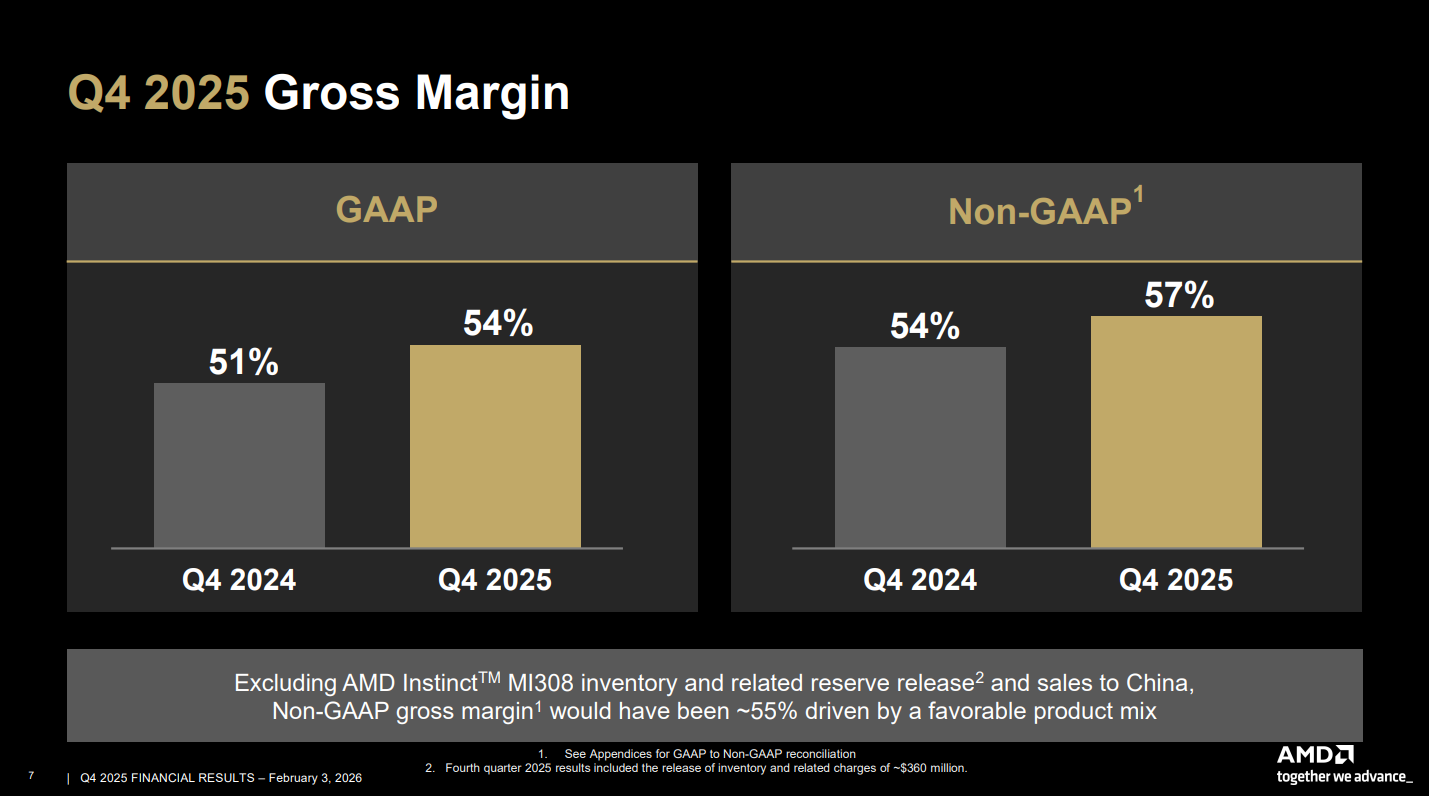

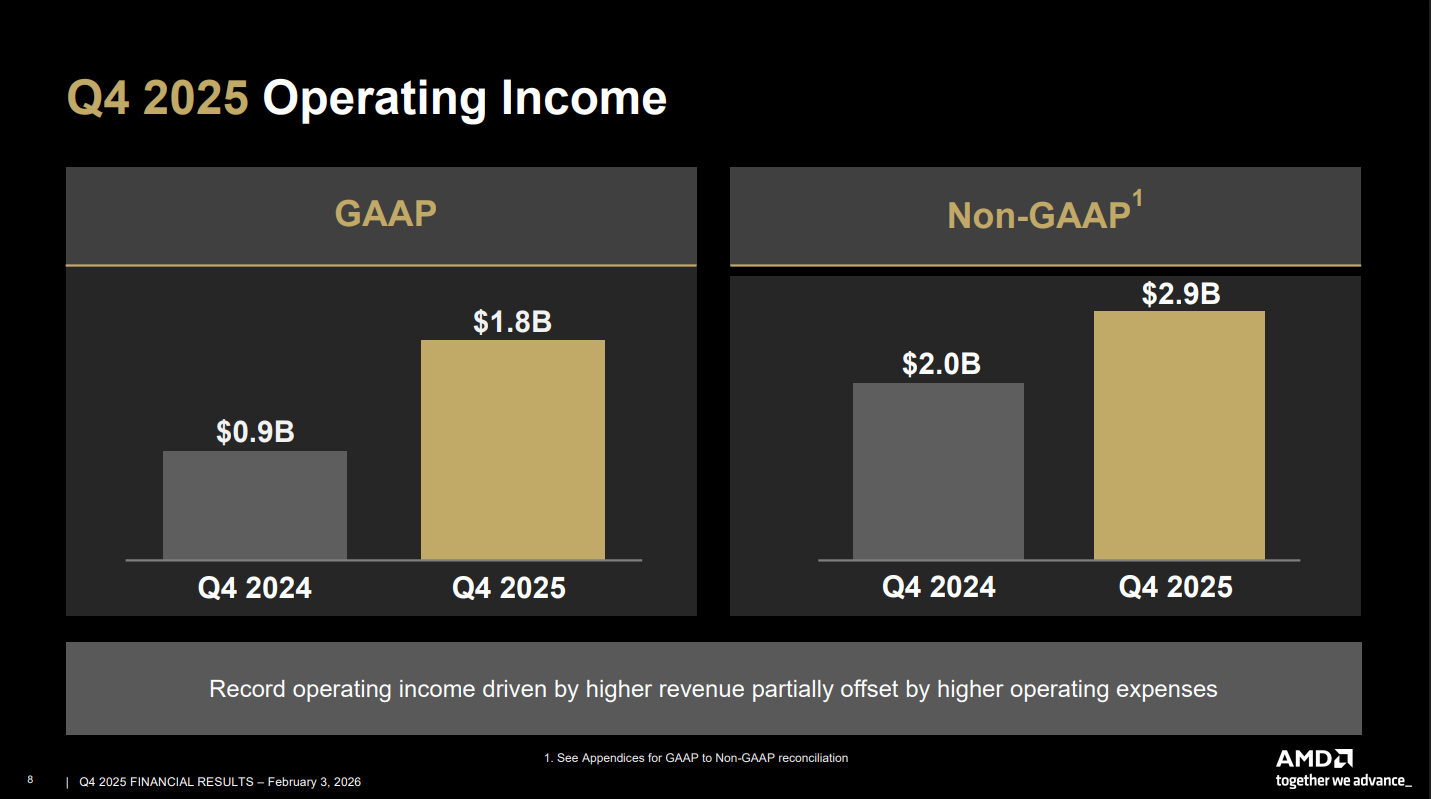

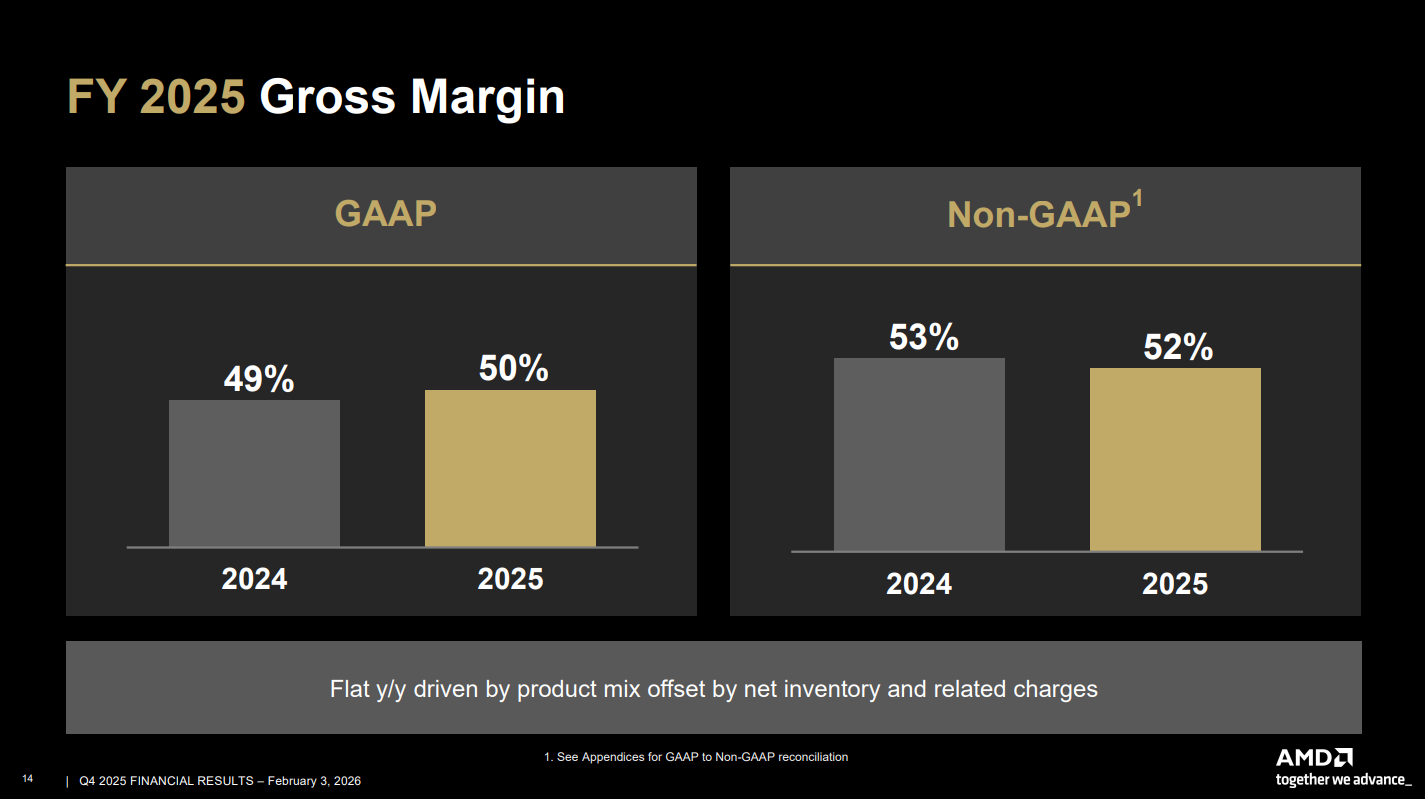

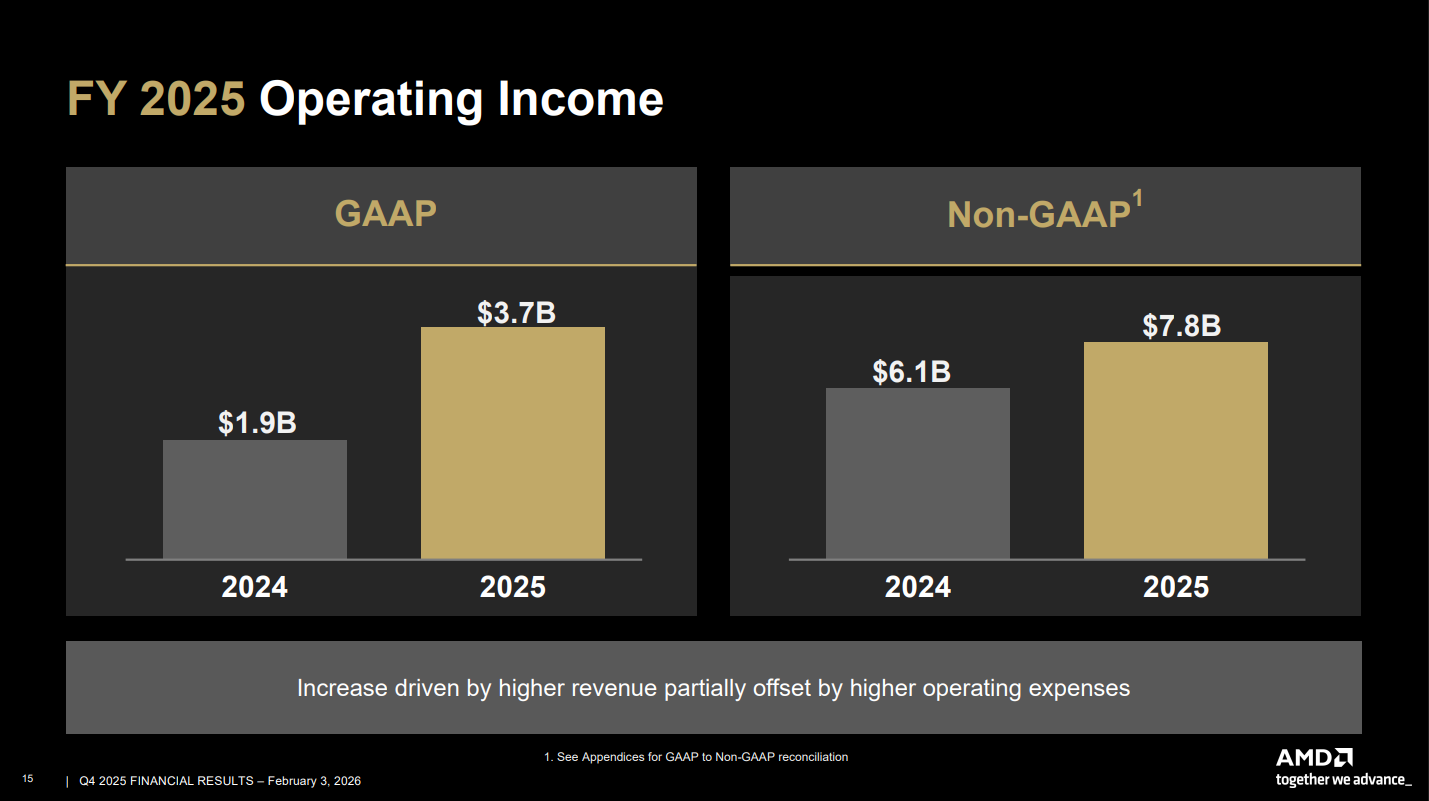

For the quarter, AMD had a gross margin of 54% and net income of $1.5 billion. For the full year, AMD’s gross margin was 52% on a non-GAAP basis with a net income of $6.8 billion.

AMD’s data center segment now represents its largest business. For the quarter, AMD reported $5.4 billion in revenue, up 39% year-over-year, and full year revenue of $16.6 billion, up 32% year-over-year. Although AMD continues to grow its data center business, it’s still significantly behind Nvidia in overall revenue. Nvidia posted $51.2 billion for its data center business in its most recent earnings, showing 66% growth year-over-year.

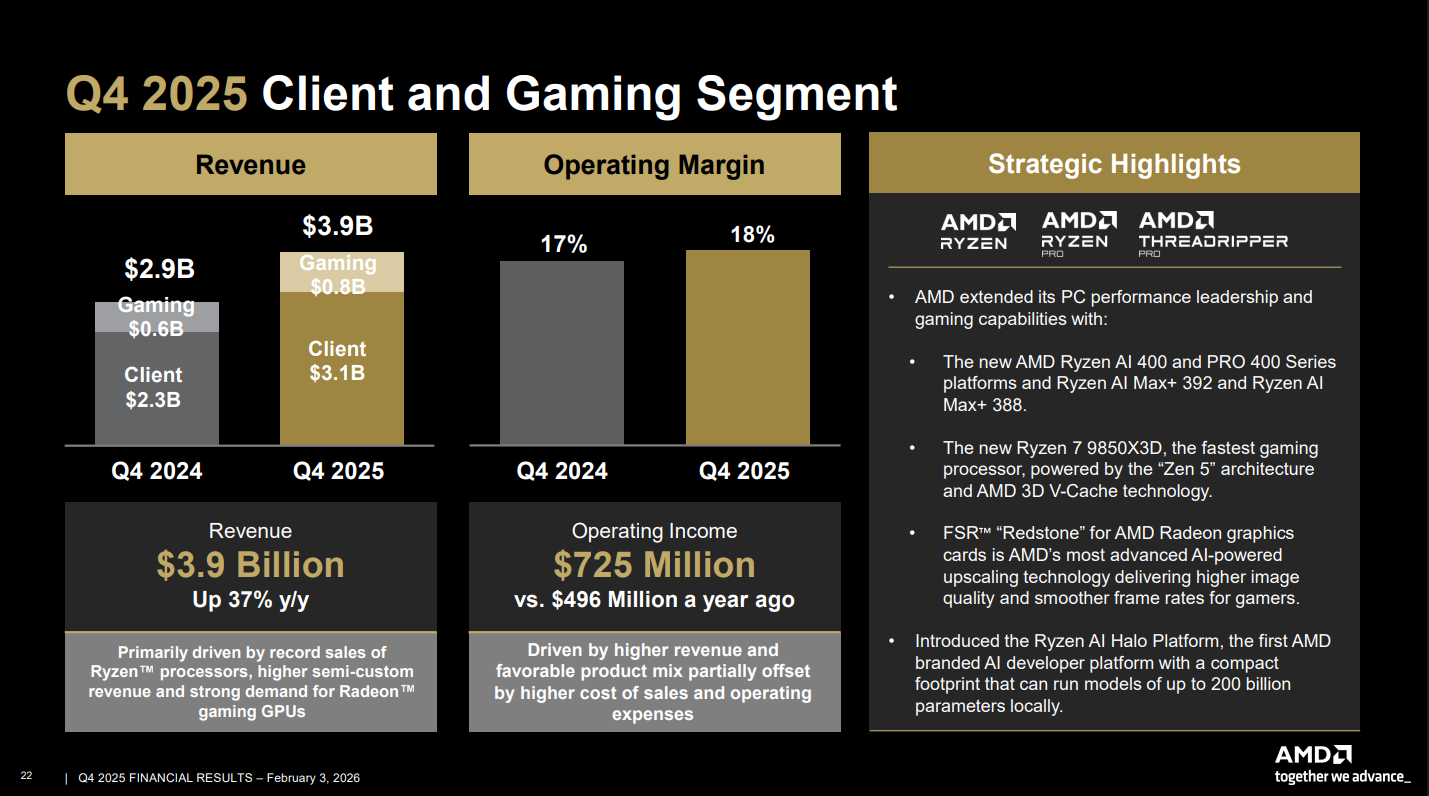

Growth in AMD’s client and gaming business was slightly lower, posting $3.9 billion for the quarter which represents 37% growth year-over-year. For the full year, the segment brought in $14.6 billion, which actually shows more growth than the data center segment; it’s up 51% year-over-year.

Especially interesting are the gaming-only numbers. AMD says gaming brought in $843 million for the quarter, which is a 50% increase year-over-year. Gaming only represents AMD’s semi-custom business for consoles like the PlayStation 5 and handhelds like the Steam Deck, along with Radeon GPUs. Ryzen CPUs fall under the client segment.

AMD maintained gaming revenue above $1 billion for multiple years before seeing a sharp decline in segment revenue in 2024. Although the revenue is up significantly for the quarter, it’s still a far cry from AMD’s peaks in 2022 and 2023. AMD attributes the increase to higher semi-custom revenue, perhaps with the proliferation of handhelds, and demand for Radeon GPUs. The latter point is particular saliant, as recent AMD GPUs like the RX 9070 XT haven’t seen the same sharp price increases and lack of availability as Nvidia’s GPUs.

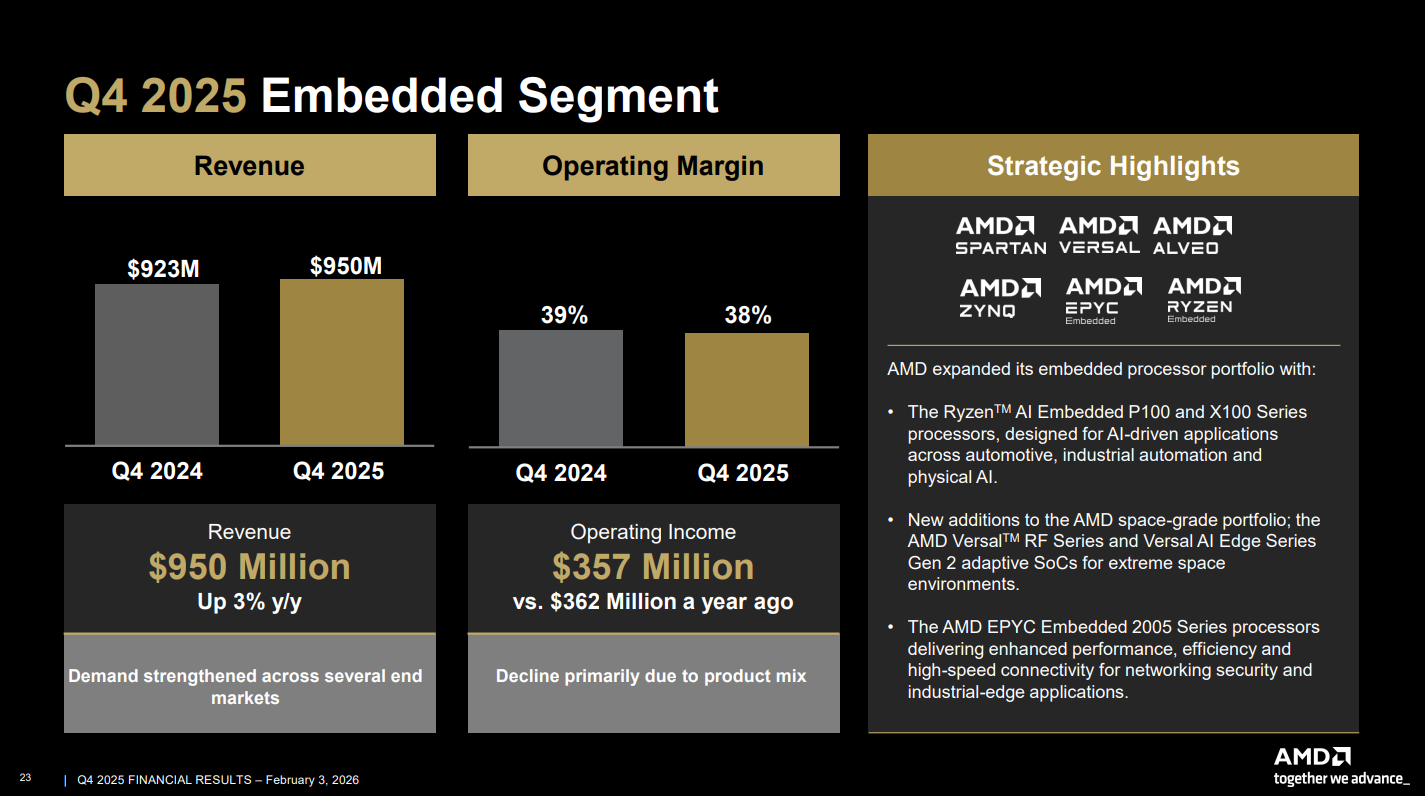

AMD’s embedded segment remains its smallest business, with $950 million in revenue for the quarter, up 3% year-over-year. Despite a small improvement for the quarter, AMD’s embedded revenue is down 3% for the full year, with full year revenue of $3.5 billion.

Follow Tom’s Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.